Mortgages

Mortgages

If you are considering remortgaging to raise capital or simply looking to move to another product with your existing lender, we can assist with this too.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

Whether you are looking to purchase your first investment property or looking to remortgage your portfolio then we can help.

You may also be considering letting your main home and purchasing another in what’s known as a ‘let to buy’. We have many years’ experience of advising on buy to let mortgages and would be happy to help with your requirements.

Some buy to let mortgages are not regulated by the Financial Conduct Authority.

Are you considering buying business premises or looking for bridging finance?

Please give us a call and we can put you in touch with experts in this complex area of lending.

Commercial mortgages are available by referral to a master broker only. Commercial mortgages and bridging finance are not regulated by the Financial Conduct Authority.

Protection

Protection

- Cancer (of specified types)

- Coronary artery by-pass surgery

- Heart attack (of specified type / severity)

- Kidney failure – major organ transplant

- Multiple Sclerosis

- Stroke

If the worst should happen and your business is not fully protected, your business could be left without enough money to pay your running costs. You may have covered the tangible assets of your business, but have you protected yourself, your share in the business or those key individuals who may contribute heavily to profits?

Equity Release

Equity Release

Equity Release, Lifetime Mortgages & Home Reversion Plan will reduce the value of your estate and can affect your eligibility for means tested benefits.

Equity release is a way of unlocking capital from your home. There are two types of equity release plan, a lifetime mortgage and a home reversion scheme. Plans are flexible allowing you to draw down money only when required you can also choose to pay some or all of the monthly interest due if required.

People release equity for all sorts of reasons including:

- Debt consolidation to pay off existing mortgages or financial commitments

- Gifts to family

- Holidays

- Home improvements

- Private healthcare

- Car or other large purchases

So if you are aged 55 or over, own your own home with little or no mortgage on it then please give us a call we can put you in touch with experts in this complex area of lending.

Equity Release is available by referral only.

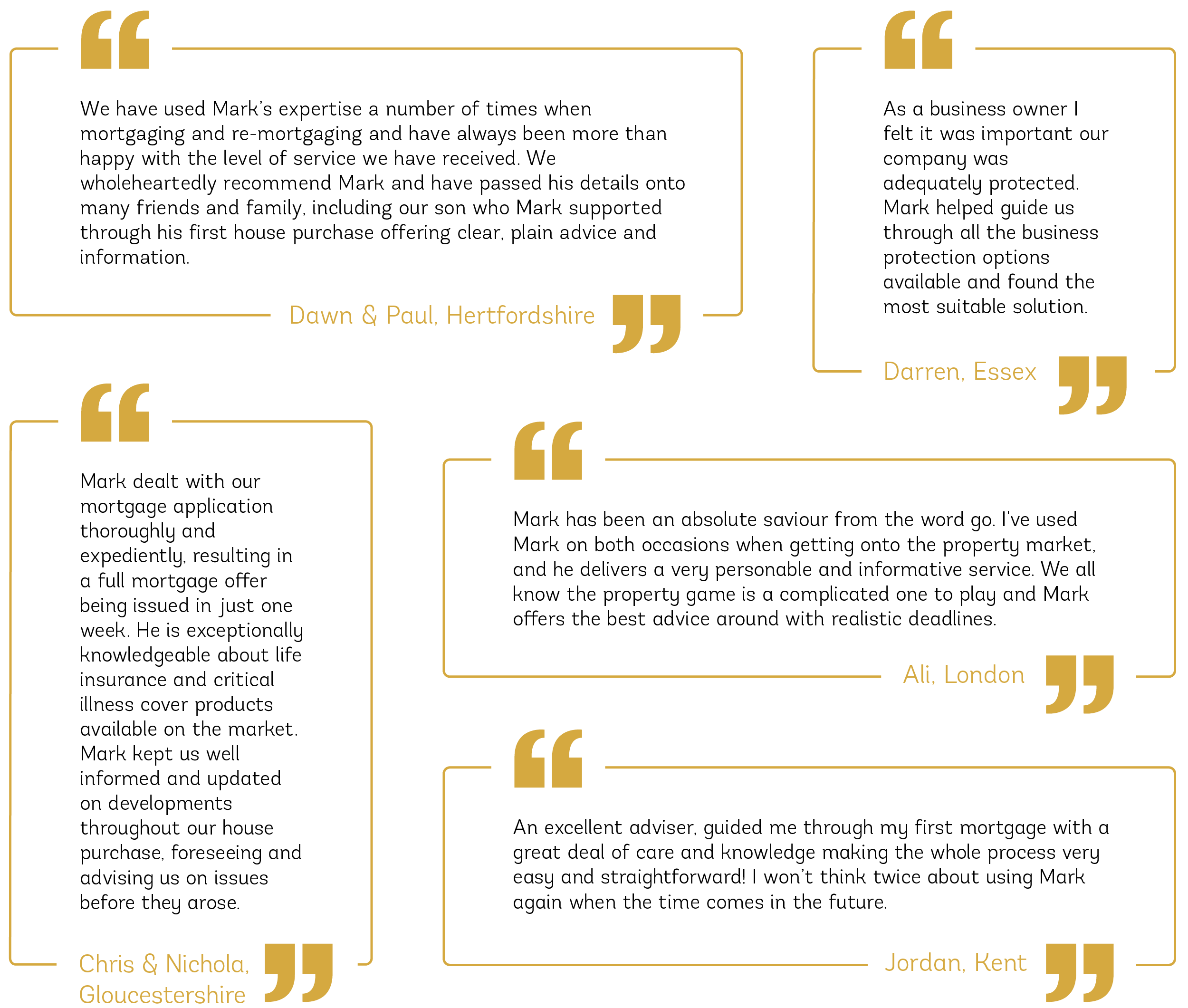

What our clients are saying…

What our clients are saying…

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE.

Prospect Financial Ltd is registered in England and Wales No. 08809965. Registered Address: Unit 2 Lakeview Stables St. Clere, Kemsing, Sevenoaks, England, TN15 6NL. Prospect Financial Limited is an appointed representative of Quilter Mortgage Planning Limited, which is authorised and regulated by the Financial Conduct Authority. Quilter Mortgage Planning Limited are entered on the FCA register under reference 440718.

View our privacy policy.